In today's fast-paced world, capturing life's precious moments has become easier and more convenient than ever, thanks to the evolution of compact … [Read More...]

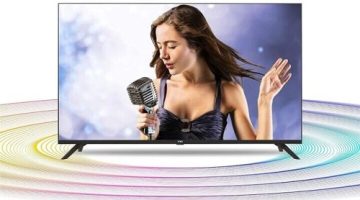

The 5 Best QLED TVs

In the realm of cutting-edge television technology, QLED TVs stand at the pinnacle, dazzling viewers with their unparalleled picture quality and … [Read More...]

Top 5 Best Computer Speakers

Discovering the perfect computer speakers can transform your audio experience from ordinary to extraordinary. Whether you're a music enthusiast, a … [Read More...]

Top 5 Best Dash Cam

A dash cam, short for dashboard camera, is a small video camera mounted on the dashboard or windshield of a vehicle to record the road ahead. Dash … [Read More...]

Top 5 Best Gaming Headset

The gaming headset market is filled with options promising immersive audio, clear communication, and maximum comfort for extended gaming sessions. … [Read More...]

Top 5 Best Mini Projector

The best mini projectors combine portability, image quality, and convenience into a compact and versatile device that can enhance your multimedia … [Read More...]

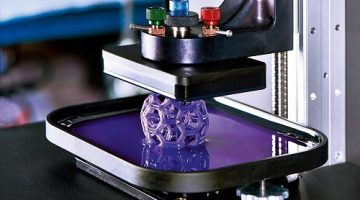

Top 5 Best 3D Printers

3D printers have revolutionized the way we create prototypes, models, and even functional objects. Their versatility, precision, and innovation make … [Read More...]

Top 5 Best Home Theater System

A home theater system enhances your entertainment experience by bringing cinema-quality audio and video into the comfort of your home. The best home … [Read More...]

Top 5 Best Budget Laptop

Looking for a reliable yet affordable computing solution? Look no further than budget laptops, which offer a perfect blend of performance, … [Read More...]

Top 5 Best Tablets

Tablets have revolutionized how we consume information, navigate the digital world, and stay connected on-the-go. Their sleek designs, powerful … [Read More...]

Top 5 Best Drones

Drones have revolutionized various sectors with their versatility and cutting-edge technology. These unmanned aerial vehicles, commonly known as … [Read More...]

Top 5 Best Bluetooth Speakers

Bluetooth speakers have revolutionized the way we experience music and audio on the go. Offering portability without sacrificing sound quality, these … [Read More...]

Top 5 Best Outdoor Security Cameras

Outdoor security cameras are essential for keeping your home or business secure. These devices provide a vital layer of protection by monitoring your … [Read More...]

Top 5 Best Air Fryers

Air fryers have revolutionized the way we cook by providing a healthier and more convenient alternative to traditional deep frying. These innovative … [Read More...]

Top 5 Best OBD2 Scanners

OBD2 scanners are essential tools for both car enthusiasts and everyday drivers looking to diagnose and resolve vehicle issues quickly and … [Read More...]

Top 5 Best SSD for PS5

Discovering the best SSD for your PS5 can significantly enhance your gaming experience, offering faster load times and smoother gameplay. The ideal … [Read More...]

Top 5 Best Mosquito Trap

Mosquito traps are an essential tool in tackling the nuisance of these blood-sucking pests. Designed to attract and capture mosquitoes, these devices … [Read More...]

Top 5 Best Spy Cameras

Spy cameras, also known as hidden cameras or surveillance cameras, have revolutionized the way we monitor and protect our homes, businesses, and … [Read More...]

Top 5 Best Cordless Vacuums

Cordless vacuums have revolutionized the way we clean our homes, offering convenience, flexibility, and powerful performance in a portable and … [Read More...]

Top 5 Best True Wireless Earbuds

True wireless earbuds have completely revolutionized the way we listen to music, make calls, and enjoy audio content on the go. Offering unparalleled … [Read More...]

Top 5 Best 65 Inch TVs

When it comes to an immersive viewing experience, nothing beats the grandeur and clarity of a 65-inch TV. These behemoth screens are the epitome of … [Read More...]

Top 5 Best Electric Shavers

Electric shavers have revolutionized the world of male grooming by providing a convenient and efficient way to achieve a clean shave. These innovative … [Read More...]

Top 5 Best Electric Glass Kettles

Best Electric Glass Kettles offer a blend of modern functionality and elegant design, making them a popular choice for tea and coffee enthusiasts … [Read More...]

Top 5 Best 40 Inch Smart TV

Looking for the perfect blend of high-quality entertainment and cutting-edge technology? Look no further than the world of 40-inch smart TVs. … [Read More...]

Top 5 Best Running Shoes

When it comes to choosing the best running shoes, a perfect blend of comfort, support, durability, and performance is crucial for every runner. The … [Read More...]

Top 5 Best Smart TVs

Smart TVs have revolutionized the way we experience entertainment in our homes, offering a seamless blend of television viewing and internet … [Read More...]

Top 5 Best Wireless Trackball Mouse

The best wireless trackball mouse combines the convenience of wireless technology with the ergonomic design and precision control of a trackball. This … [Read More...]

Top 5 Best Electric Fly Swatter

Electric fly swatters have revolutionized the battle against pesky insects, offering a quick and efficient way to eliminate flies and other flying … [Read More...]

Top 5 Best SATA Internal Solid State Drive

The quest for top-notch performance and reliability in storage solutions has led to the rise of SATA Internal Solid State Drives (SSDs) as a favored … [Read More...]

Top 5 Best 32-Inch Smart TV

The 32-inch smart TV has become a popular choice for those seeking a balance between size and functionality in their home entertainment setup. … [Read More...]

Top 5 Best Car Folding Umbrella

Introducing the Best Car Folding Umbrella, a must-have accessory for all car owners. This innovative umbrella is designed for convenience and … [Read More...]

Top 5 Best Automatic Water Bottle Pumps

The convenience and efficiency of automatic water bottle pumps have revolutionized the way we stay hydrated. These innovative devices are designed to … [Read More...]

Top 5 Best Auto Face Tracking Tripod

The Best Auto Face Tracking Tripod is a revolutionary device designed to enhance your photography and videography experience. This innovative tripod … [Read More...]

Top 5 Best Samsung Phones

Samsung is renowned for its high-quality smartphones, offering a wide range of options for every user. From cutting-edge technology to sleek designs, … [Read More...]

Top 5 Best 2 in 1 Laptop

In the dynamic realm of technology, the convergence of versatility and functionality has propelled the emergence of 2-in-1 laptops as a formidable … [Read More...]

Top 5 Best Android TV Box

In the ever-evolving landscape of home entertainment, the Android TV Box has emerged as a formidable contender, offering a gateway to a world of … [Read More...]

Top 5 Best Laptops

In today's fast-paced world, having a reliable and efficient laptop is essential for both personal and professional use. With countless options … [Read More...]

Top 5 Best Wireless Headphones

Wireless headphones have revolutionized the way we listen to music, watch movies, and make phone calls. With their convenience and freedom from … [Read More...]

Top 5 Best Synthetic Oils

When it comes to engine lubrication, synthetic oils have become increasingly popular due to their advanced formulation and superior performance. … [Read More...]

Top 5 Best Toilets

Finding the best toilets is essential for ensuring a comfortable and hygienic bathroom experience. Whether you are renovating your home or simply … [Read More...]

Top 5 Best Protein Powders

Protein powders have gained immense popularity in the fitness and health industry due to their ability to provide a concentrated dose of protein. … [Read More...]

Top 5 Best Robot Vacuums

Are you tired of spending hours on household chores, especially vacuuming? Well, look no further because the solution to your problem lies in the … [Read More...]

Top 5 Best Soundbars

Soundbars have become an essential addition to any home entertainment system, providing an immersive audio experience that enhances our movie nights, … [Read More...]

Top 5 Best Bathroom Faucets

When it comes to creating a functional and stylish bathroom, selecting the best bathroom faucets is crucial. A bathroom faucet not only serves as a … [Read More...]

Top 5 Best Quilting Machines

Quilting machines have revolutionized the art of quilting, making it easier and more precise than ever before. Whether you're a beginner or an … [Read More...]

Top 5 Best Range Hoods

When it comes to creating a clean and fresh kitchen environment, range hoods play a crucial role. A range hood, also known as an extractor hood, is a … [Read More...]

Top 5 Best Welding Helmets

When it comes to welding, safety should always be a priority. And one of the most important protective gears for welders is a welding helmet. A … [Read More...]

Top 5 Best Serger Sewing Machines

Serger sewing machines are essential tools for those who love sewing and want to achieve professional-looking finishes on their garments and projects. … [Read More...]

Top 5 Best Sewing Machines

Sewing machines are essential tools for people who love to sew their own clothes, costumes, or even home decors. In the market, there are many types … [Read More...]

Top 5 Best Sewing Machines For Beginners

In the world of crafting and DIY projects, having a reliable and high-quality sewing machine can make all the difference. For beginners just starting … [Read More...]

The Best Lace Wedding Dresses Review

The wedding dress selection is arguably one of the most exciting events for the bridal party, and especially for the bride and maids. That said, this … [Read More...]

The Best UV Flashlight Review

There are so many uses of ultraviolet flashlights. They can be used by investigators hunting for body fluids, locating spilled automotive fluids, … [Read More...]

The Best Case Fan Review

Those of us using computers most of the time can get pissed off when the computer slows down. Chances are overheating could be one of the causes. … [Read More...]

The Best Vinyl Cutters Review

The graphic design industry has grown over the years. With the invention of different machines, from printers to heat presses, beautiful graphics are … [Read More...]

Best T-shirt Heat Press Machine Review

If you’re into the clothing business, you must have thought about the t-shirt printing business at one time or another. This is such an attractive … [Read More...]

The Best Mug Press Machine Review

If you’re interested in graphic design, then you’ve probably thought about rendering your creation onto a surface. If not, then you had better think … [Read More...]

The Best Gumball Machines Review

A gumball machine is a commercial or toy instrument. You can make crazy gumballs with the best gumball machine. It is one of the most amazing … [Read More...]

The Best Bonsai for Indoors Review

[su_note note_color="#f6f6f6"]Thinking of a thoughtful gift for the office, home, dorm, or classroom? Try the best bonsai for indoors. Since not … [Read More...]

The Best Feather Dusters Review

Cleaning around a fully packed house or office can never be easy, especially if you do not have the right equipment to aid you. You will want to clean … [Read More...]

The Best 30 Inch Range Hoods Review

Nowadays, in our modern homes, we are bound to use the things that help us perform core activities. These assistive things are of great importance … [Read More...]

The Best Atomic Alarm Clocks Review

Although smartphones have greatly affected the usage of traditional alarm clocks, one can't deny their usage and significance. That being said, the … [Read More...]

The Best Soap Cutter Review

The startup of an entrepreneur always commences with humble beginnings, no matter how influential their lifestyle is. No one starts with millions of … [Read More...]

The Best Electric Pencil Sharpener Review

Among the greatest achievements of modern society is that technology made it possible to automate some of the most menial tasks. This includes … [Read More...]

The Best Sublimation Printers Review

Transferring images from paper to another object used to be a very tricky process back in the day. However, this isn’t too much of a feat anymore, … [Read More...]

The Best Cocktail Dress Review

A cocktail party is basically a party event where cocktails are served. Some of these events may be organized for business purposes, but most of them … [Read More...]

The Best Engraving Machines Review

You can see there are many types of engraving machines that are available in the market. Each of them is unique in their ways in one way or the other. … [Read More...]